Meet Marie Copeland

Here to work for you not the big banks. Getting you bank or alternative financing for home purchase or refinancing a home mortgage is more than a job. It's a passion to help families and small business owners realize their real estate financing dreams.

- Welcome to Axcess Mortgage

- Alternative mortgage financing

- Home equity mortgage

- Should I refinance home mortgage

Should I Refinance Home Mortgage?

Should i refinance my mortgage Canada Easy Guide

Should I refinance home mortgage rule of thumb - yes. You should if you need money and refinancing mortgage Canada options make sense and have money saving benefits. Let us help you with non-bank, equity lenders Hamilton and Ontario wide. Refinancing home equity lenders in Ontario are pros in real estate financing when you don't fit the bank's complicated mortgage demands.

mortgage refinance news

You thought home equity mortgage loan was just to refinance mortgage bad credit or no income mortgage refinance for self employed? Not any more, meet no mortgage stress test best home equity loan.

Should I refinance home mortgage with income too low ?

Income too low to qualify for mortgage amount needed? Bank turned me down... sound familiar?

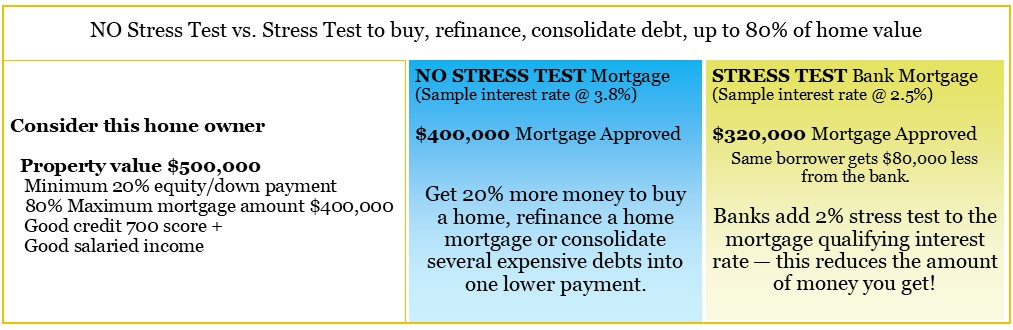

In 2018 the Canadian Government regulated banks to tighten their lending policies. It was ruled that a 2% mortgage stress test is added to the contract rate you are offered to qualify for mortgage, even though in reality you are getting a lower interest rate.

Now, thousands of home owners no longer qualify for mortgage amount needed, even with excellent credit and income. With the 2% mortgage stress test borrowers now get about 20% less money.

This pushed thousands of home owners into the home equity mortgage market supported by non-bank lenders. Best home equity mortgage loan offers more flexible ratios but at a bit higher home mortgage refinancing rates.

In Ontario we have lenders who offer no mortgage stress test real estate financing, getting you more money. This is important when you need debt help in Hamilton or throughout Ontario or buying a home.

Refinance a home mortgage challenge. Mortgage no stress test vs stress test

Check out the chart below to learn how the added mortgage stress test affects your refinance home equity mortgage options, even when you have good credit and stable income, on approved credit (o.a.c.).

Can you refinance your mortgage with bad credit?

Should I refinance with bad credit? Yes.

Bad credit mortgage refinance is the cheapest money you can get in this situation. Non-bank, alternative mortgage lenders are the refinance with poor credit specialists. Home mortgage refinancing rates are higher than the banks' but it is still the most cost effective way to solve money problems.

There are many good reasons a refinance mortgage with bad credit is attractive to homeowners:

- Home equity bad credit refinancing gets you tax free cash to invest (RRSP reducing your tax liability).

- Refinance with bad credit is a good way to raise a down payment to buy another property, grow your rental property assets.

- Refinance home mortgage for home renovation improving your home.

- Refinance bad credit to buy a car. Bad credit refinance to buy a car is cheaper money than high interest and high monthly payments car loans.

- Refinance mortgage to buy out spouse in divorce. It's a viable spousal buyout program where one spouse needs to buy out the spouse leaving the matrimonial home.

When you have an urgent need for money but have credit problems, home equity refinance with bad credit is your best option,

Should I refinance my mortgage to pay off debt? Yes.

People have many reasons to refinance with bad credit, consolidation loans Ontario being the most common. Debt consolidation loan bad credit using home equity mortgage loans gives you awesome credit card debt relief and saves you money, even at the higher home mortgage refinancing rates. You consolidate several expensive debts into one lower monthly payment. Paying credit card debt improves your household cash flow, helps you rebuild financially. Consolidation loans Ontario save you money, big!

What about mortgage refinance for self employed with no proof of income?

You will need a no income verification refinance for small business owners. Mortgage refinance for self employed no proof of income loans is available up to 80%. While no income verification refinance benefits are similar to other home equity mortgage loans, the approval process is different. How to refinance mortgage with bad credit and self employed? Visit mortgages for business owners no income verification mortgages or read about mortgages for self employed.

Should I refinance home mortgage, you ask? Will refinance home equity mortgage resolve any of the problems below, you decide:

- do I need the money now and have a good reason to refinance home mortgage,

- I'm struggling with outrageous debt. Will poor credit home mortgage consolidation loans Ontario give me the credit card debt relief,

- is there enough equity in my home that I can cash out tax free and solve my problem by refinancing home mortgage,

- will low credit score home loans refinancing solve the problem I have today, improve my cashflow and repair credit.

Marie Copeland FSU, Hamilton mortgage brokers giving you answers about how to refinance mortgage with bad credit, mortgage refinance for self employed or other refinance mortgage to pay off debt. Contact us to get Hamilton refinance mortgage help Ontario wide.

Should i refinance home mortgage?

We Love Helping Families Save Money, Make Money

Should I refinance home mortgage you ask? Thank you for visiting our website. Come back often to get mortgage refinance news and current home mortgage loan refinance information. Share with others who need refinance home mortgage help.

*Lenders change their products and interest rates regularly and without notice. Check with us for updates.

1 (905) 537-8815

Banks and AAA lenders pay us for your service. Some alternative mortgage financing and all private mortgage broker fees are payable by clients.