Meet Marie Copeland

Here to work for you not the big banks. Getting you bank or alternative financing for home purchase or refinancing a home mortgage is more than a job. It's a passion to help families and small business owners realize their real estate financing dreams.

- Welcome to Axcess Mortgage

- Alternative mortgage financing

- Home equity mortgage

- Debt consolidation bad credit

Change starts with Debt Consolidation Bad Credit Solutions

Let Us Show You How To Save Money On Mortgage Payments

Debt consolidation bad credit changes ideas into reality, Improving lives

Loans for debt consolidation

Change starts with debt consolidation bad credit, when you don’t fit banks qualifying demands for paying credit card debt. Banks don't accept credit problems for their home equity loan refinancing products approvals. Alternative mortgage lenders provide debt consolidation Hamilton and Ontario wide through mortgage broker Canada professionals not the banks.

How does debt consolidation Hamilton work? It lays a foundation for saving money ontario wide

Here to give you bad credit debt help to end credit card debt! Debt consolidation loan bad credit is a form of refinancing a home mortgage using alternative mortgage lenders. Here are few solutions:

- alternative mortgage funding ways to pay off debt for home owners with bad credit or,

- help for homeowners who are a bit short on income to qualify for mortgage under the banks qualifying policies and,

- funding mortgages for businessowners with unique problems, including theno proof of income loans for self employed.

We offer debt consolidation in Hamilton and Ontario wide and custom fit to give you bad credit debt help. Every debt consolidation loan bad credit program is unique to you with its own ideal strategy to end credit card debt.

In addition to standard debt consolidation bad credit, alternative mortgage lenders have their own specialties, niches. For example, a certain debt consolidation lender could be an expert in self employed mortgages for business owners. Another may be a near prime lender providing help for homeowners with good credit, whose income is just a bit too low to qualify for mortgage offered by the banks.

When you need bad credit debt help in Hamilton or wherever you may live, and you have equity in your home but are struggling with a whole bunch of bills, be sure to contact us for a loan for debt consolidation Hamilton and Ontario wide. You get access to both the least expensive money and money that is at higher alternative home mortgage refinancing rates than banks. Plus, the bad credit mortgage refinance money you get is tax free.

Did you know you can save money on mortgage payments? Let us show you how.

The credit card debt loans process, for paying credit card debt, lays the foundation for rebuilding your life financially. Not only you quickly go from average credit card interest rates of 8%-26%+ to much lower home mortgage refinancing rates, but you immediately start improving your cashflow and credit rating in the process. You get debt relief in Hamilton or wherever you are in Ontario

Debt consolidation bad credit gives you a fresh chance to rebuild financially.

Embracing how to become debt free, getting credit card debt relief

When you have money problems you can improve your odds when you refinance mortgage bad credit, consolidating debt using your home equity. After that, you can start re-establishing your credit. Debt consolidation in Hamilton or all over Ontario wide will propel you to new heights of financial freedom.

Here is a tip how to pay off mortgage early with bad credit mortgage refinance, bit by bit. Consider putting some of the debt consolidation mortgage money saved to increase your monthly payments. Many alternative lenders allow up to 20% prepayments. You can take advantage of this by increasing your new lower mortgage payments by 20% or just save your money and periodically put it back into your mortgage as your prepayment privilege. This will reduce the amount of overall interest your will pay.

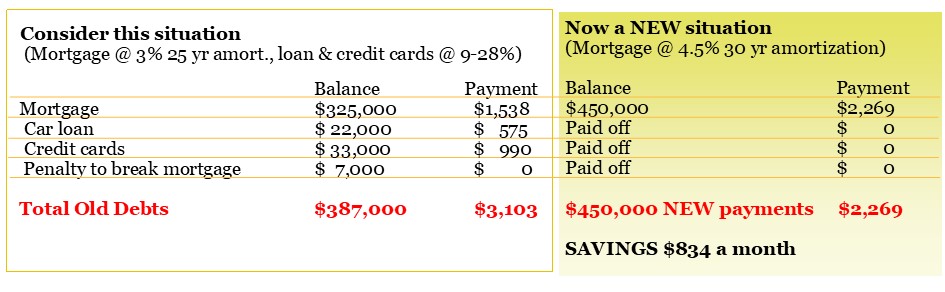

How to refinance with bad credit - how to become debt free? The chart below gives you sample ways to pay off debt, changing your thinking from paying credit card debt to how to be debt free, improving your life, liberating.

debt consolidation loan for self employed when you need bad credit debt help

How To Save Money On Mortgage Payments

Below, you save $834 a month even at higher debt consolidation refinancing interest rates.

debt consolidation bad credit lower mortgage payments to save

Above, mortgages when self employed for debt consolidation loan bad credit were used to illustrate the above example. There are numerous no income verification mortgage self employed solutions. Similar consolidation loans Ontario are suitable for home owners with credit problems.

This illustration shows that even though the existing mortgage was at a lower interest rate, the consumer debt load the home owners carried was high, with a total monthly payment at $3,103.

In addition to paying off debt, the homeowners wanted a home remodel loan to redo the bathroom and kitchen, improving their home value. Finance company home repair loans are more expensive, ranging 14% - 30% and more, while a mortgage is at a much lower interest rate.

If your situation is similar, check out the benefits of refinancing a home mortgage even if you only qualify for a bad credit score mortgage. You can get debt relief, get additional money for improving your home, avoiding expensive home repair loans and save by reducing your monthly payments. The choice is clear.

Marie Copeland FSU, getting you refinance home mortgage debt relief Hamilton and Ontario.

Back to top of debt consolidation bad credit home equity mortgage. is one of the ways to pay off debt and save.

*Lenders change their products and interest rates regularly and without notice. Always check for lender updates.

Axcess Mortgage and Loans Financing Co. Ltd. | FSRA 10420

www.mariecopeland.ca

1 (905) 537-8815

Banks and AAA lenders pay us for your service. Some alternative mortgage financing and all private mortgage broker fees are payable by clients.